Gold holds firm tone ahead of Fed minutes

Spot gold regained traction on Wednesday and bounced 0.5% following Tuesday’s 1% drop, keeping steady tone on strong demand as safe haven against geopolitical tensions and a hedge against inflation.

Traders await release of Fed minutes of its Jan 25/26 policy meeting, due later today, to get more clues about the US central bank’s next steps.

The US Federal Reserve signaled it will start its tightening cycle in March, with 0.25% hike, but a number of market participants expects more aggressive approach after inflation in January surged to a 40-year high, and bet for 0.5% raise of interest rates.

Economists expect inflation to remain stubbornly high that would prompt the Fed to act faster than expected, with such scenario to be negative for gold as higher interest rates increase cost of non-yielding metal.

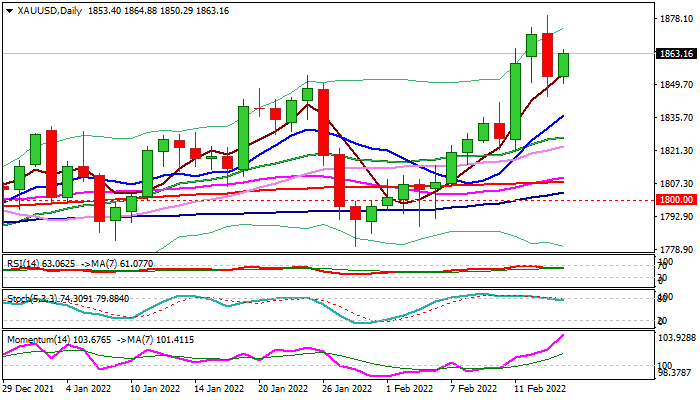

Technical studies on daily chart remain bullish but somewhat extended that may slow bulls on attempts towards key barriers at $1876/79 (50% retracement of $2074/$1677 descend / 20-d upper Bollinger band /2022 high) which guard targets at $1900/23 (round-figure / Fibo 61.8%).

Solid supports lay at $1841/36 (Fibo 38.2% of $1780/$1879 upleg / rising 10DMA), with break here to sideline bulls for deeper pullback.

Res: 1865; 1874; 1879; 1881

Sup: 1856; 1850; 1844; 1841