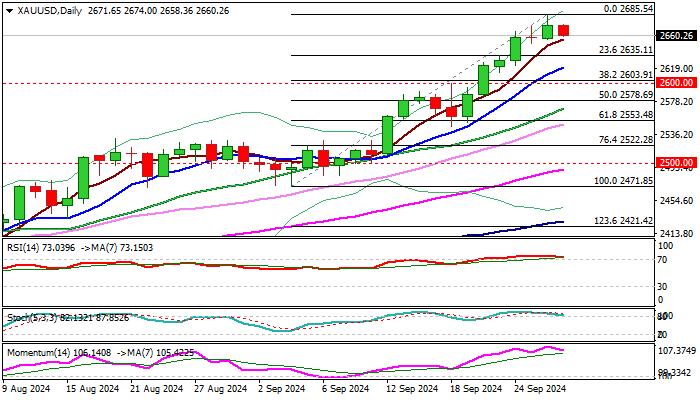

GOLD- limited pullback from new record high to precede final attack at $2700 target

Gold price eased on Friday after the metal hit new record high on Thursday, with end-of-week partial profit taking being behind the move.

Pullback was so far shallow and the price unlikely to make a stronger dip, but rather consolidation and positioning for fresh push higher.

Sentiment remains firmly bullish in current circumstances of growing expectations for further rate cuts by major central banks and heated geopolitical situation which threatens to escalate, keeping investors in safety.

The latest rally neared initial target at $2700, where bulls may face headwinds. However, bullish structure is expected to remain firm in persisting supportive fundamentals.

Daily studies are overbought that contributes to correction scenario, but initial supports at $2655 (Thursday’s low / 5DMA) and $2650 (100HMA) are still intact.

Rising thick hourly Ichimoku cloud ($2660/$2646) also makes significant support and likely to provide additional headwinds.

Dips should be ideally contained above $2620 (rising 10DMA) to keep bulls intact and guard pivotal $2600 support zone (Fibo 38.2% of $2471/2685 / psychological) violation of which would risk deeper correction.

The yellow metal is on track for the third consecutive weekly gain which adds to bullish outlook, though technical selling on overbought weekly studies should be considered.

Res: 2675; 2685; 2700; 2714

Sup: 2655; 2650; 2635; 2620