Japanese yen rises 1.3% vs dollar on political news / economic data

USDJPY rose to three-week high (146.49) and subsequently fell over three full figures on Friday, on speculations about new prime minister’s support to BOJ’s further policy tightening, which was seen as a violation of central bank’s independence, initially weakening yen and then sparking strong rally after news proved false.

Yen strengthened more after US data showed moderate increase in consumer spending in August, while inflation continued to slow, adding to expectations for another Fed outsized rate cut (bets are currently 50-50).

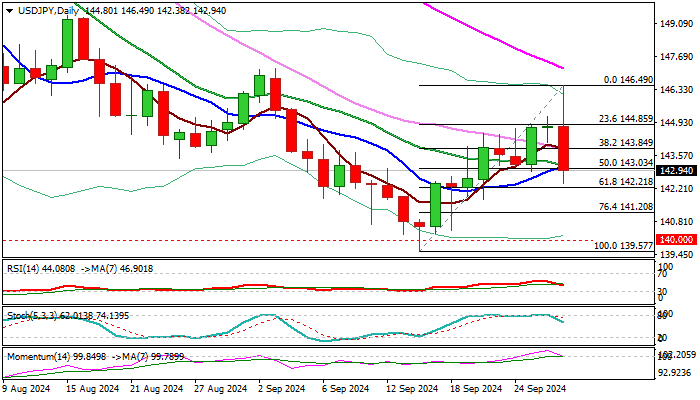

Technical structure is weakening on daily chart as falling 14-d momentum is cracking the centreline and about to break into negative territory, MA’s returned to full bearish setup, and a double bull-trap above 144.82 (Fibo 23.6% of 161.80/139.57).

Friday’s large bearish daily candle with long upper wick, to weigh on near-term action, along with falling and thickening daily cloud, which stays above the price.

Daily close below 143.00 zone (broken 50% of 139.57/146.49 /10DMA) to boost bearish signal and keep fresh bears firmly in play for extension through 142.21 (Fibo 61.8%) and 141.68 (Aug 5 spike low).

Res: 143.16; 143.84; 144.02; 144.85

Sup: 142.21; 142.00; 141.68; 141.20