Gold loses ground after hawkish signals from Fed

Gold fell further on Thursday, deflated by hawkish stance of the US Federal Reserve, as the central bank kept interest rates on hold in its September’s policy meeting which ended on Wednesday, but signaled another hike by the end of the year and likely to keep high interest rates through 2024.

Hawkish Fed’s posture on interest rates renewed demand for dollar and increased pressure on metal’s price.

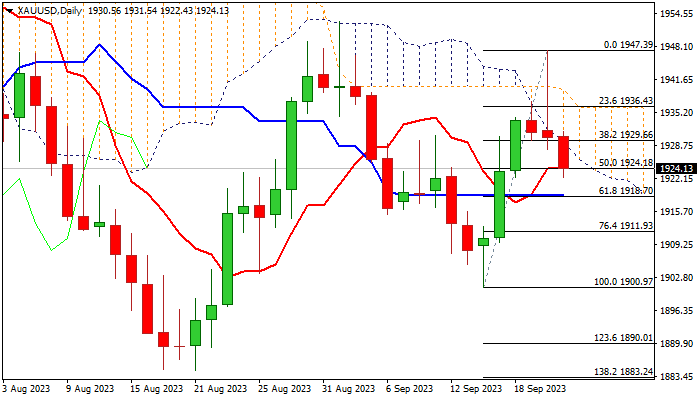

Fresh weakness contributes to formation of reversal pattern on daily chart after the action on Wednesday was strongly rejected above daily cloud top, leaving daily Doji candle with long upper shadow and forming a bull-trap pattern.

Today’s acceleration lower hit over 50% retracement of $1900/$1947 upleg, adding to signals that near-term bull-phase is likely over.

Close below 50% retracement ($1924, reinforced by 200DMA) is needed to confirm signal and risk deeper drop towards Fibo targets at $1918/11 (Fibo 61.8% / 76.4% respectively) and expose key near-term support at $1900 (Sep 14 higher low).

The 14-d momentum indicator remains in negative territory and RSI/Stochastic are heading south, reinforcing negative near-term outlook.

The base of daily cloud ($1929) marks solid resistance, with today’s close below here needed to keep the action biased lower.

Res: 1929; 1936; 1939; 1947

Sup: 1918; 1911; 1905; 1900