Swiss franc falls sharply after SNB surprise to keep rates on hold

EURCHF surged 0.8% in immediate reaction to decision of the Swiss National Bank to pause its current cycle of interest rate hikes.

In the policy meeting held today, the SNB kept its interest rate unchanged at 1.75%, against widely expected 25 basis points increase, arguing their decision by easing inflation in Switzerland, but left the door open for possible further hikes.

The SNB pulled the break this time, to use the pause to assess the situation and see whether the measures taken until now are sufficient to keep the price stability within desired levels, after the increase by total 250 basis points pushed inflation from 3.5% peak in 2022 to the central bank’s 0%-2% target range.

The price rose to the highest in over two months in strong post-SNB acceleration (the biggest daily advance since Jan 11).

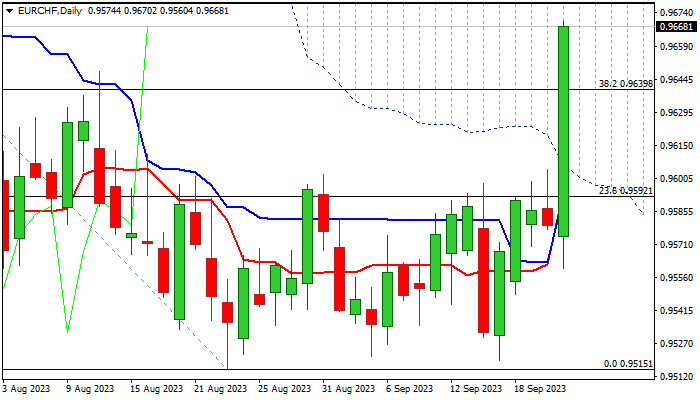

Fresh bulls penetrated thick falling daily Ichimoku cloud and signaled formation of a higher base at 0.9520 zone, targeting key barriers at 0.9678/81 (50% retracement of 0.9841/0.9515 bear-leg / daily cloud top), with firm break here to add to strong bullish signals and open way for further advance.

Significant acceleration of bullish momentum adds to improving conditions on daily chart, however overbought conditions would contribute to headwinds that bears are expected to face on approach to 0.9678/81 pivots.

Broken Fibo 38.2% (0.9639) should contain dips to keep fresh bulls in play and offer better levels to re-enter bullish near-term action, for acceleration above 0.9700 zone.

Only return and close below daily cloud base (0.9600) will neutralize bulls and signal return to a multi-week range.

Res: 0.9681; 0.9716; 0.9764; 0.9780

Sup: 0.9639; 0.9600; 0.9560; 0.9520