Gold may come under increased pressure on better than expected US NFP data

Gold price is slightly higher in early Friday after 1.2% drop previous day, with limited range as traders await release of US labor data.

Gold price pulled back from $1865 (Jan 4 peak, the highest in nearly seven months) after surprise US data (private sector hiring rose well above expectations and weekly jobless claims fell to a multi-month low) signaled that Fed would stay on tightening path longer than expected that lifted dollar.

Investors look for further signals from US Dec labor data, which could further lift the greenback and increase pressure on metal, on release above expectations.

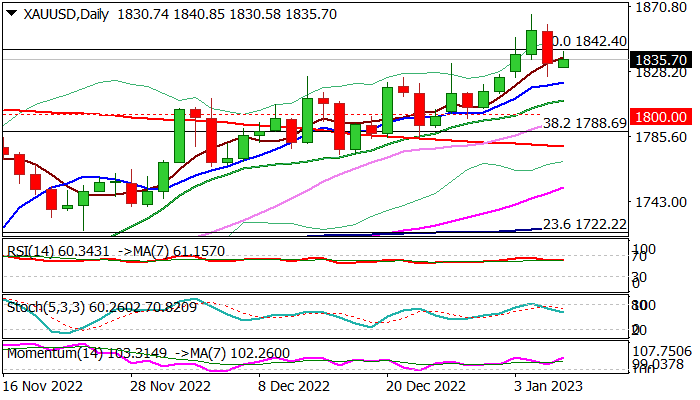

An array of daily moving averages and psychological $1800 level offer supports at $1821/$1796 zone, with break lower to weaken near-term structure and risk deeper drop.

Bullish scenario, on the other hand, sees minimum requirement on weekly close above cracked Fibo barrier at $1842 (50% retracement of $2070/$1614) that would improve the tone and shift focus towards targets at $1896/$1900 (Fibo 61.8% / psychological).

Res: 1842; 1865; 1879; 1896

Sup: 1821; 1809; 1800; 1779