Gold price is consolidating under new record high, ahead FOMC minutes

Gold keeps firm tone and consolidating under new record high ($2531) posted on Tuesday, with third consecutive daily close above $2500 level, pointing to clear break.

The yellow metal holds in a steep multi-month uptrend and has registered gains of nearly 22% since the start of the year.

Strong migration into safety on Fed rate cut expectations, geopolitical tensions, uncertainty over economic situation in the US and upcoming US Presidential Election, continued to lift gold price, which rose by almost $500 in seven months of 2024.

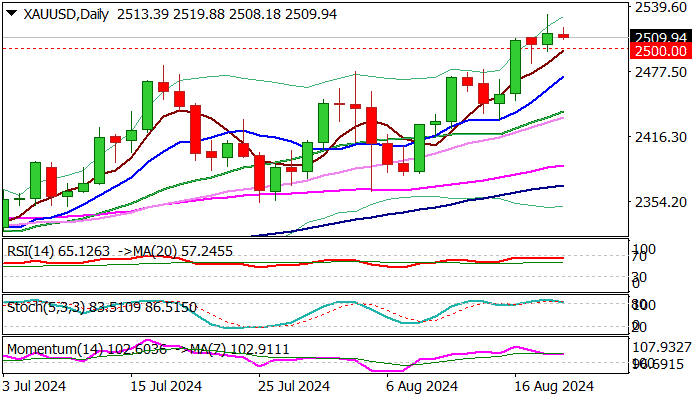

Technical picture is firmly bullish on daily chart and contributes to positive outlook, though some price adjustment cannot be ruled out on overbought conditions and fading bullish momentum on daily chart.

Markets widely expect dovish tones from FOMC minutes (due today) and Friday’s speech from Fed Chair Powell, which will also provide more details about the depth of rate cuts.

Limited dips are likely to mark positioning for fresh push higher, with solid supports at $2500/$2483 (psychological / former top) to ideally contain and offer better buying opportunities.

Caution on drop below rising 10DMA ($2473) which may generate an initial signal of stronger correction and expose lower pivots at $2439/32 (20DMA / Aug 15 higher low).

Res: 2531; 2564; 2600; 2614

Sup: 2500; 2483; 2473; 2450