Gold price surges to 13-month high on recession fears and signs that Fed may pause rate hikes

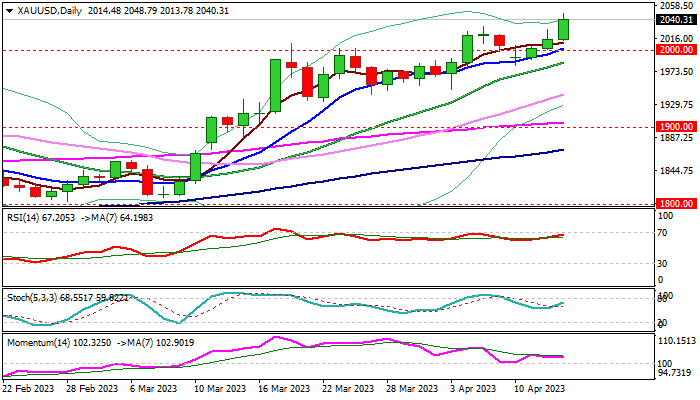

Gold hit the highest levels since March 2022 after strong acceleration higher on Thursday, with metal’s price advancing 1.5% until early US session.

Weaker than expected US economic data on Wed/Thu added to existing concerns that the economy is likely to enter a mild recession and boosted bets that the Fed may pause in interest rate hikes, which increased demand for safe-haven gold.

Initial bullish signal was generated on return above psychological $2000 level, with the second weekly close above this barrier to confirm signal and reinforce bullish structure.

Bulls are heading towards key barriers at $2070/74 (Mar 2022 / Aug 2020 tops) with the latter marking the yellow metal’s record high.

Another important signal is expected from the eventual monthly close above $2000, as two previous attempts failed, despite spikes well above the level.

This would set the stage for stronger advance, as weakening fundamentals and bullish technical studies work in favor of such scenario.

However, bulls are very likely to face headwinds on approach to $2070/74 targets which mark significant barriers and also due to overbought conditions on weekly chart.

Expect limited consolidation before fresh push higher if current favorable conditions persist, with bulls to remain intact while the price stays above $2000.

Res: 2048; 2055; 2070; 2074

Sup: 2032; 2013; 2000; 1984