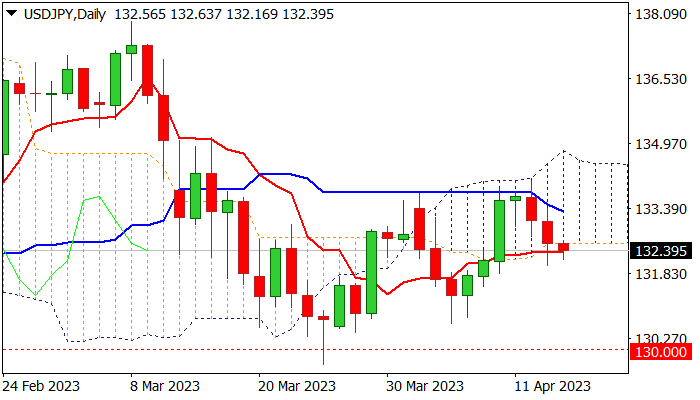

Increased downside risk under daily cloud

Near-term action holds in red for the third consecutive day, as bears regained control after a triple upside rejection at daily Ichimoku cloud top.

Today’s extension below daily cloud base (132.56) and daily Tenkan-sen (132.33) adds to downside risk, with close below these levels needed to confirm scenario.

South-heading indicators on daily chart and weekly momentum about to break into negative territory, contribute to negative near-term outlook, along with long upper shadow on weekly candle which also points to increased pressure.

Fundamentals are also negative for the dollar, as weaker than expected recent economic data suggest that the Fed may take a breather in hiking rates and also warn that economy may enter a mild recession.

Sustained break below daily cloud base would increase risk of retest of pivotal support at 130.62 (Apr 5 trough), loss of which will signal a double top at 133.80 zone and open way for acceleration through key supports at 130.00/129.64 (psychological / Mar 24 spike low).

Caution on repeated failure to clear daily cloud base which would sideline immediate downside risk but keep bears in play while the action stays below daily Kijun-sen (133.31).

Lift above 133.80 platform and daily cloud top will be a game changer.

Res: 133.06; 133.31; 133.80; 134.78

Sup: 132.01; 131.30; 130.62; 130.00