Gold remains constructive, eyes US CPI data / tariffs for fresh signals

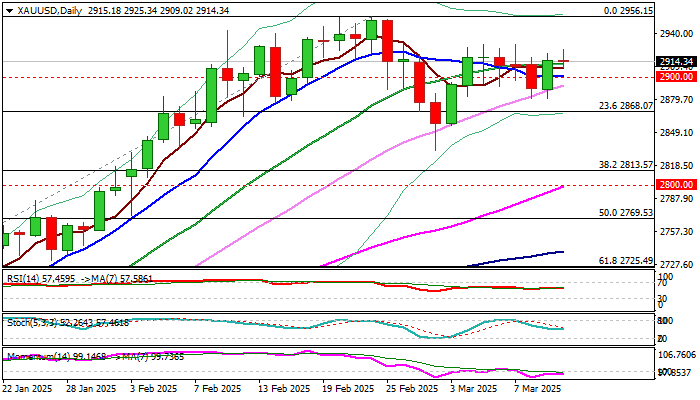

Gold price is held in a narrow range on Wednesday morning and pressuring near-term congestion ceiling ($2930).

Near term bias is expected to remain with bulls while the action stays above psychological $2900 level, although daily indicators are mixed (negative momentum / MA’s in bullish setup).

Markets await release of US Feb inflation report (2.9% f/c vs 3.0% in Jan) for more signals to the central bank about the stance on monetary policy.

Another key factor that could strongly influence metal’s performance are US tariff policies, which were extended by the latest decision to impose 25% tariff on all imports of steel and aluminium to the US.

Escalation of trade war would further undermine global economy and negatively impact economic growth, as many developed economies struggle to speed up recovery or being in recession.

Economists also point out the growing risk of stronger slowdown of the US economy which would add to already fragile global economic situation, with heated geopolitical situation contributing to overall supportive environment for gold.

Initial support at $2900 is reinforced by 10DMA, followed by a higher base at $2880 and Fibo level at $2868 (23.6% of $2582/$$2956 upleg).

Res: 2930; 2942; 2956; 2985

Sup: 2908; 2900; 2891; 2880