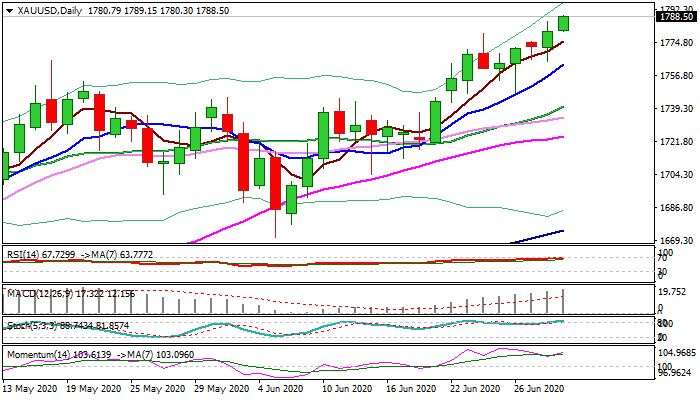

Key barriers at $1795/$1800 in focus

Spot gold hit new highest level in nearly eight years on Wednesday, continuing to shine on increased safe-haven demand over worries about the global economic impact of surging new coronavirus infections.

The yellow metal rallied on Tuesday, driven by Q2-end flows and entered the third quarter in strong bullish mode, after advancing 21% during the period of crisis (Mar/June).

Gold keeps its strong safe-haven appeal despite encouraging signs from global economic data that point to recovery and focuses key barriers at $1795/$1800 (2012 peaks / psychological).

Break of these levels would generate strong bullish signal for extension towards all-time high at $1920 (Aug 2011) and would bring in sight psychological $2000 barrier.

Bullish studies on daily chart add to positive outlook, but overbought stochastic warns of strong headwinds and possible consolidation before breaking higher.

Dips are expected to provide better opportunities to enter bullish market, with strong supports at $1765/62 (former high of 18 May / rising 10DMA) to ideally contain and keep intact next important levels at $1740 (20DMA), $1724 (55DMA) and $1720 (top of thick daily cloud.

Only break of the latter would sideline bulls and allow for deeper correction.

Res: 1790; 1795; 1800; 1823

Sup: 1780; 1765; 1762; 1750