Kiwi dollar probes again through 0.60 pivot and hits new 2025 high

NZDUSD jumped to new 2025 high on Monday, in extension of Friday’s 1.9% rally, after fresh threats of US tariffs on Apple and European Union and subsequent U-turn in policies with the EU, deflated US dollar and boosted risk appetite.

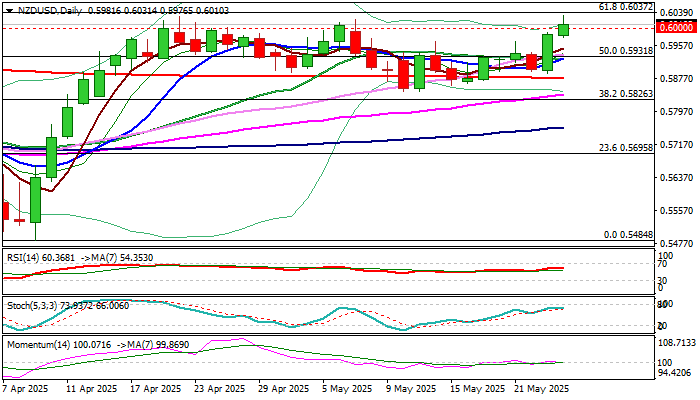

Kiwi dollar probed again through psychological 0.60 barrier (following several rejections here in late April / early May).

Near term action is underpinned by formation of daily Tenkan/Kijun-sen bull-cross and thick daily cloud, but loss of bullish momentum should be considered as initial warning as bulls again face headwinds above 0.60 barrier.

Threats of another failure to register a clear break above 0.60 (after a number of rejections) keep in play scenario of potential stall.

Look for today’s reaction at 0.60 level for fresh signal.

RBNZ policymakers will meet on Wednesday and are widely expected to cut interest rates by 25 basis points, however, more focus will be on signals about central bank’s next steps.

Res: 0.6037; 0.6087; 0.6100; 0.6167

Sup: 0.6000; 0.5946; 0.5931; 0.5900