Much lower than expected build in crude stocks supports oil prices but bulls lack momentum to resume

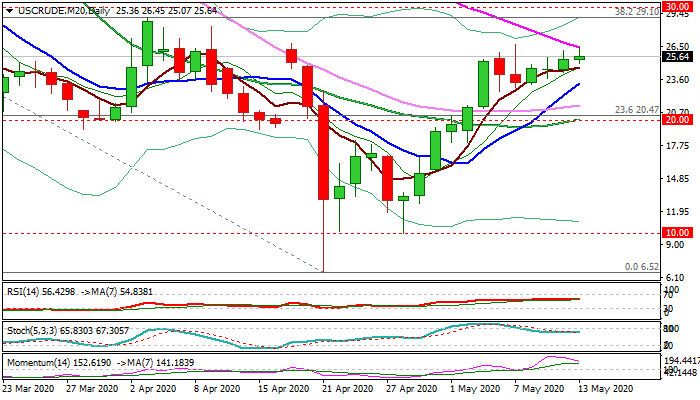

WTI oil price rose above $26 level and cracked falling 55DMA ($26.45) after US weekly data showed that US crude inventories rose by only 0.7 million barrels against expectations for 4.1 million barrels build and last week’s increase of 4.5 million barrels.

Drop in US crude stocks signals that demand in the US is picking up and reducing fears of oversupply and full storage places.

The contract holds in green for the fourth straight day, as a part of larger recovery and approaching the first layers of key barriers at $26.45 (55DMA) and $26.71/82 (7 May / 17 Apr highs).

Bulls may show hesitation here as bullish momentum on daily chart is fading and stochastic is heading south, while massive falling daily cloud continues to weigh (cloud base currently lays at $29.05).

Consolidation needs to stay above rising 10DMA ($23.25) to keep bulls intact., for attempts through $26.45/82 and attack at key barriers at $29.05/10 (daily cloud base / Fibo 38.2% of $65.63/$6.52) and psychological $30 barrier.

Only drop below $20 (20DMA / psychological) would neutralize and shift focus lower.

Res: 26.45; 26.82; 28.32; 29.05

Sup: 25.00; 24.69; 23.25; 22.56