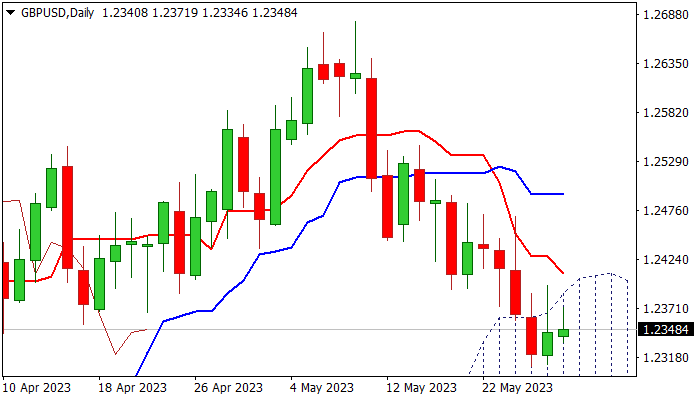

Near-term action looks for clearer direction signal as daily studies are mixed

Cable is standing at the front foot at the start of the week, though recovery attempts were so far limited.

Near-term action remains capped by the top of rising daily cloud for the third consecutive day, with strong upside rejection on Friday, signaling lack of strength for more significant recovery for now.

Signals on daily chart are mixed, as daily cloud top and formation of 10/55DMA bear cross (1.2404) weigh, while fading negative momentum and north-heading stochastic about break out of oversold zone, underpins.

We look for initial signals on clear break above 1.2400 resistance zone (bullish) or loss of 1.2300 support zone (new two-month low / 100DMA) to signal near-term direction.

Violation of upper pivots would open way for stronger recovery and expose targets at 1.2450/1.2500 zone, while break below lower triggers would risk extension of pullback from 1.2679 (2023 high) towards supports at 1.2240/1.2180.

Res: 1.2400; 1.2450; 1.2472; 1.2500

Sup: 1.2310; 1.2288; 1.2241; 1.2180