Near-term action remains propped by thick daily cloud and extends gains above key Fibo barrier

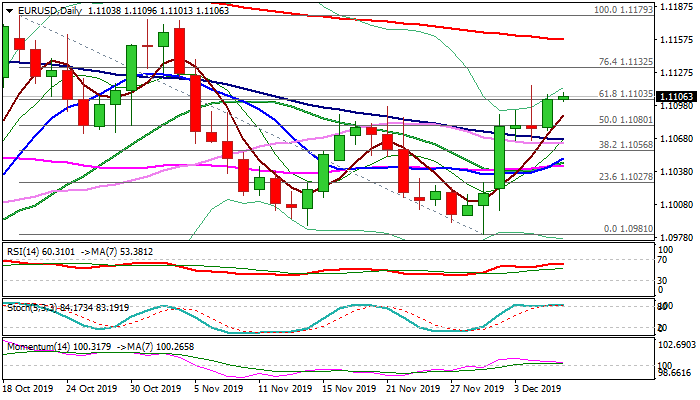

The Euro maintains firm tone and extends above cracked key Fibo barrier at 1.1103 (61.8% of 1.1179/1.0981) in early Friday’s trading.

Fresh strength emerged on Thursday after third straight rejection at daily cloud top, keeping bullish stance, with weekly close above 1.1103 pivot needed to confirm and spark further advance.

The pair is on track for strong bullish weekly close which adds to positive outlook.

Weak dollar on trade uncertainty and signs of weakness in the US economy, as well as rising fears that US jobs data may fall well below expectations, contribute to Euro’s strength.

Near-term action remains underpinned by thick daily cloud and daily MA’s in bullish configuration, but overbought stochastic and fading bullish momentum warn that bulls may face headwinds en-route to 1.1132 (Fibo 76.4%) and 1.1157 (falling 200DMA).

The single currency is expected to remain biased higher while price action holds above daily cloud.

Res: 1.1115; 1.1132; 1.1157; 1.1179

Sup: 1.1096; 1.1080; 1.1065; 1.1056