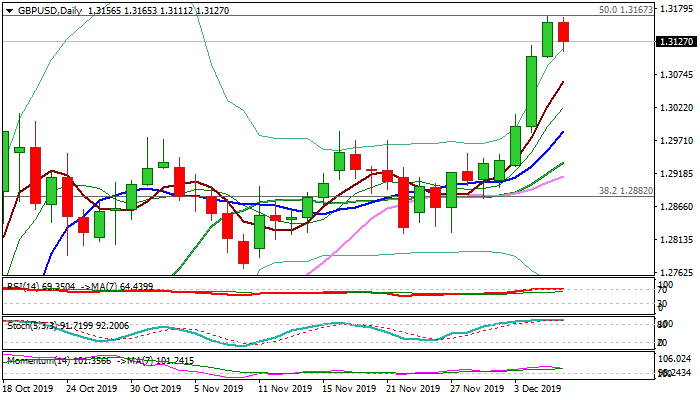

Bulls are pausing under new 7-mth high and awaiting US jobs data for fresh signals

Cable eases in early European trading on Friday as bulls are taking a breather, following impressive rally of nearly 2% in past four days that resulted in extension to the highest level in over seven months.

Sterling was in strong bullish acceleration during this week, boosted by rising expectations for Tory outright majority in 12 Dec election that would allow for bringing Brexit story to its end and also lifted by weaker dollar.

Corrective easing is triggered by profit-taking as well as overbought daily studies and for now seen as positioning for fresh advance, as larger uptrend from 1.1958 remains intact.

Weekly close above cracked 200WMA (1.3102) is needed for fresh signal for bullish continuation.

Broken 100WMA offers support at 1.3052, with dips to be contained above former pivotal barriers at 1.30 zone.

All eyes are on US jobs report, with NFP forecasted for strong rise in Nov (186K f/c vs 128K in Oct) and earnings and unemployment expected to remain unchanged (3.0% and 3.6% respectively).

Pound may extend pullback if NFP come in line or above consensus that would inflate the dollar.

On the other side, downbeat ADP private sector jobs report (released two days ago and often used as indication for NFP), warns that the number of new jobs in Nov may fall significantly below expectations that would boost sterling and unmask key m/t barrier at 1.3381 (13 Mar high). Fibo 76.4% barrier at 1.3045 and former high at 1.3012, where corrective action should find ground.

Res: 1.3167; 1.3179; 1.3200; 1.3235

Sup: 1.3111; 1.3063; 1.3045; 1.3012