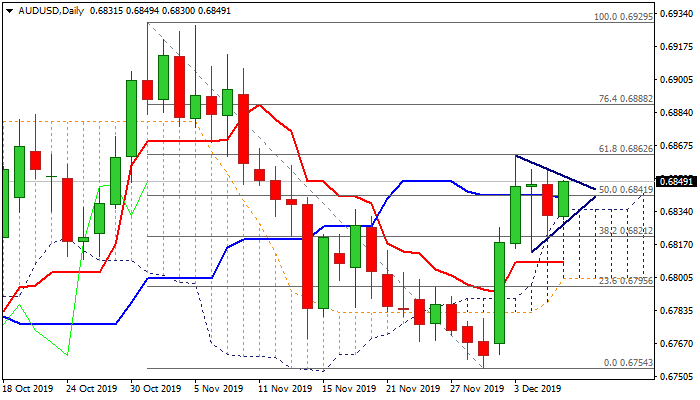

Aussie stands at the front foot ahead of US data but still holding within the triangle

The Aussie maintains bid tone on Friday and recovers the most of previous day’s losses, after dips were repeatedly contained by the top of thickening daily cloud which continues to support.

Weaker US dollar contributed to fresh advance, but the action in last three-days remains directionless and moving within a triangle.

Rising bullish momentum and MA’s in bullish setup on daily chart are supportive, but overbought stochastic threatens of limiting recovery.

Triangle’s upper border line lays at 0.6851 and break higher is needed to open way for renewed attack at key Fibo barrier at 0.6862 (61.8% of 0.6929/0.6754), clear break of which is needed for bullish signal and extension of bull-leg from 0.6754 (29 Nov low).

On the other side, pivotal supports lay at 0.6834/28 (daily cloud top / triangle’s support line), with break here to weaken near-term structure and shift focus towards key supports at 0.6800/0.6795 (daily cloud base / Fibo 61.8% of 0.6754/0.6862 recovery leg).

US jobs data are key event today, with strong figures to deflate Aussie, while downbeat results would spark fresh acceleration higher.

Res: 0.6851; 0.6862; 0.6888; 0.6906

Sup: 0.6841; 0.6834; 0.6820; 0.6800