Post-NFP slump risks extension below daily cloud

The Euro accelerated lower on Friday, hit by upbeat US NFP data (Nov 266K vs 186K f/c while Oct figure was revised to 156K from 128K).

Non-farm payrolls hit the highest in 10 month, signaling the strength of US labor sector amid rising concerns that the US economy is weakening, following recent downbeat manufacturing data.

Average earnings ticked lower in Nov (m/m 0.2% vs 0.3% f/c) but strong upward revision of Oct figure (0.4% from 0.2%) improves the picture, while unemployment rate fell back to 3.5% in Nov.

Overall picture from jobs report is positive that would give good signal to the US policymakers about economy’s resilience, in their policy meeting next week.

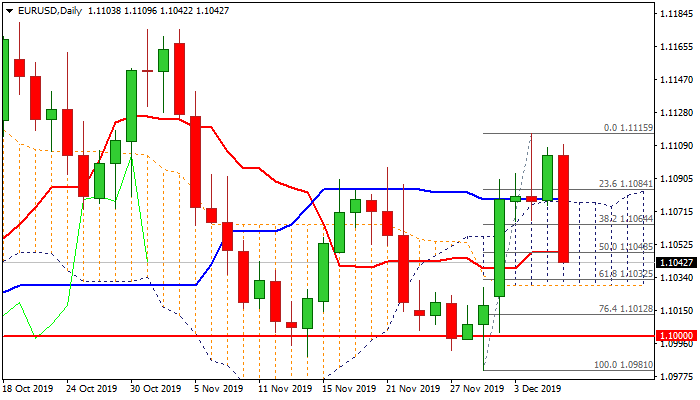

Fresh weakness keeps the single currency on track for the biggest daily fall in one month, while deep penetration into thick daily cloud, which strongly underpinned recent action, adds to negative near-term outlook.

Today’s post-data fall retraced so far over 50% of 1.0981/1.1115 upleg, with initial bearish signal seen on break and close within daily cloud.

Weaker near-term structure (as momentum broke into negative territory, stochastic reversed from overbought territory and RSI is heading south) maintain risk of further weakness and probe below pivotal supports at 1.1032/29 (Fibo 61.8% of 1.0981/1.1115 / daily cloud base) loss of which would confirm reversal and risk retest of key 1.10 support zone.

Res: 1.1064; 1.1077; 1.1093; 1.1109

Sup: 1.1029; 1.1012; 1.1000; 1.0981