Near-term action to remain directionless while holding between 10 and 55DMA’s

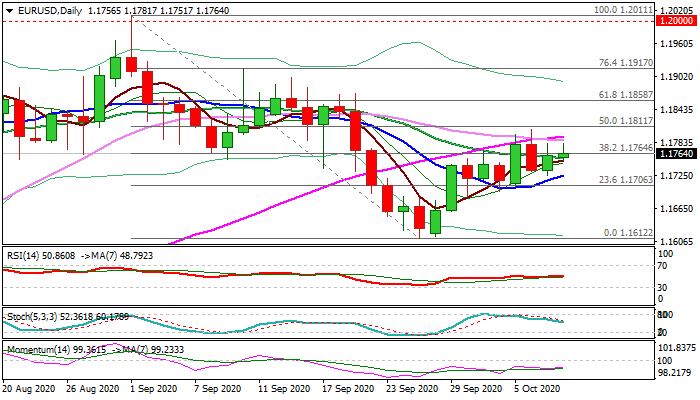

The Euro remains constructive on Thursday, inflated by weaker dollar on fresh risk sentiment, but lacking strength for stronger advance and renewed attack at pivotal barriers at 1.1794/1.1807 (55DMA / Tuesday’s high).

Daily techs are bearishly aligned (momentum remains negative a stochastic continues to head south, while MA’s are mixed) with more positive signals seen on weekly chart (rising bullish momentum, stochastic and RSI), but bulls require confirmation on weekly close above pivot at 1.1790 (10WMA).

Near-term action is expected to remain biased higher while holding above north-heading 10DMA (1.1725), but without direction as long as 55DMA caps.

We look for initial direction signals on break of either boundary, with loss of 10DMA to weaken the structure and risk sub-1.17 dip, while sustained break above 55DMA would unmask key resistances at 1.1858/70 (Fibo 61.8% of 1.2011/1.1612 pullback / daily cloud top).

Res: 1.1794; 1.1807; 1.1858; 1.1870

Sup: 1.1751; 1.1725; 1.1686; 1.1658