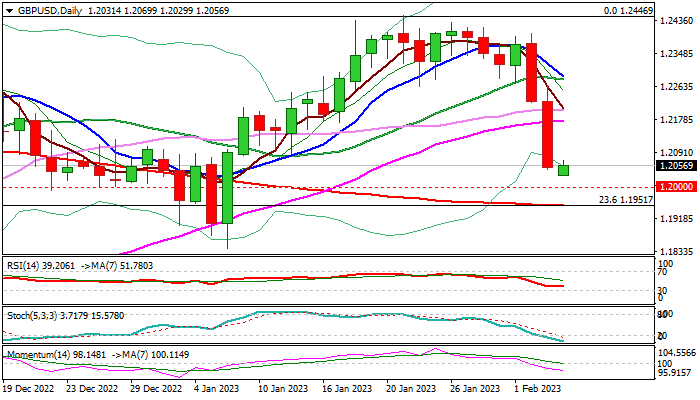

Near term action weighed by rejection under weekly cloud and formation of reversal pattern

Bears are taking a breather in European trading on Monday after strong acceleration on Thu/Fri which resulted in a weekly loss of 1.7% (the biggest weekly fall since the third week of September).

Formation of Doji reversal pattern on a weekly chart, following a multiple rejection under the base of falling weekly cloud weighs on near-term action, adding to pressure from stronger dollar on upbeat US jobs data.

Weakening daily studies on rising negative momentum and MA’s (10/20/55) turning to bearish setup, contribute to signals of possible further weakness, but oversold conditions suggest that bears may pause for consolidation, before attacking supports at 1.20 (psychological) and 1.1951 (200DMA), with extension below 1.1841 (Jan 6 trough) to confirm a double-top (1.2447) and signal reversal.

The action should be ideally capped by the top of daily cloud (1.2140) reinforced by daily Kijun-sen, to keep fresh bears intact, with potential extended upticks to stall under daily Tenkan-sen (1.2230) to maintain bearish bias.

Res: 1.2070; 1.2100; 1.2140; 1.2189

Sup: 1.2030; 1.2000; 1.1951; 1.1900