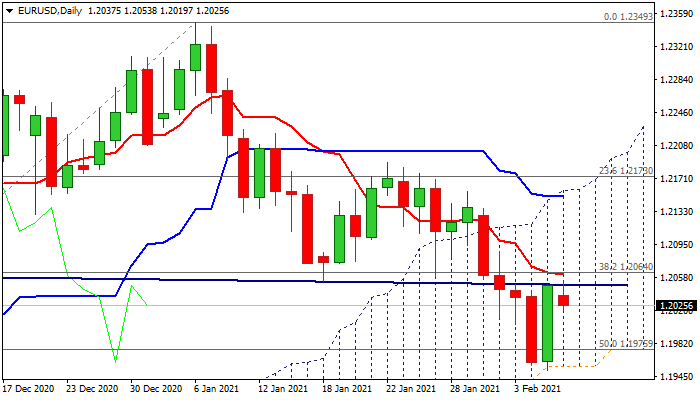

Near-term bias remains negative below broken neckline

The Euro weakened on Monday, remaining at the back foot, despite strong rally on Friday (up 0.89% for the day) that formed bullish engulfing pattern on daily chart.

The action stays for the fourth straight day below the neckline of the head and shoulders pattern that was completed last week and continues to weigh.

Near-term risk remains shifted to the downside, as moving averages (10,20,30,55) are in bearish setup and formed several bear-crosses, while negative momentum continued to strengthen.

Pullback from 2021 high (1.2349) found solid support at daily cloud base / 100DMA (1.1956), but near-term bias is expected to remain negative as long as the action stays capped by the neckline.

Close below 1.20 level would generate initial signal for retest of cloud base, break of which would open way for deeper drop.

Only clear break above the neckline (1.2049) would neutralize bears and generate initial reversal signal.

Res: 1.2049; 1.2064; 1.2103; 1.2120

Sup: 1.2000; 1.1956; 1.1922; 1.1887