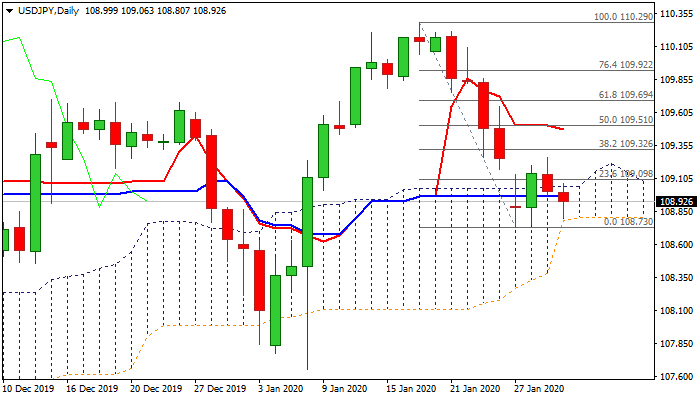

Near-term focus shifts lower but key support still hold

The pair extended weakness near daily cloud base (108.78) on Thursday, following strong upside rejection under key Fibo barrier at 109.32 (38.2% of 110.29/108.73) and bearish close within daily cloud on Wednesday.

Rising fears of China virus spreading keep strong demand for safe-havens that continues to underpin yen.

Bears need clear break od cloud base and pivotal Fibo support at 108.65 (61.8% of 107.65/110.29) to generate signal for continuation and test of 200DMA (108.47).

Rising bearish momentum supports scenario but daily indicators are still conflicting and lacking clearer direction signal.

On the other side, bears would be sidelined on lift and close above 109.32 pivot.

Res: 109.04; 109.32; 109.51; 109.69

Sup: 108.78; 108.65; 108.47; 108.27