News of further production cut maintain optimism but fears of fresh corona infections weigh

WTI oil rose $1.5 on Monday after Saudi Arabia announced that it will further reduce the output by one million bpd.

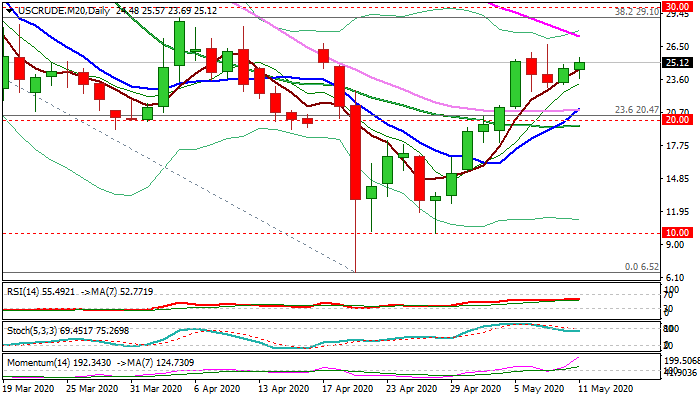

Oil price holds in green for the second day and fresh advance signals that shallow pullback from new recovery high ($26.71) might be over.

Near-term sentiment remains positive on prevailing optimism, with the action being supported by steep rise of bullish momentum and bullish crosses formed by 10, 20 and 30 DMA’s.

On the other side, recovery is still fragile, with renewed fears of fresh coronavirus infection already weighing on markets and threatening to pressure oil prices stronger if situation deteriorates.

Falling 55DMA marks first significant obstacle at $27.40 and break here would expose key levels at $29.10 / $30.00 (Fibo 38.2% of $65.63/$6.52 / daily cloud base / 3 Apr high / round-figure barrier).

The latest consolidation low at $22.60 marks initial support ahead of more significant 10/30 bull-cross ($20.95), psychological $20 level and 20DMA ($19.58), loss of which would signal deeper fall.

Res: 24.96; 26.71; 26.82; 27.91

Sup: 23.69; 22.93; 22.60; 20.95