Oil extends pullback, pressured by rise in crude stocks and Fed’s pessimistic outlook

WTI oil stands at the back foot on Thursday and is trading around $2.5 lower in early US session compared to opening levels.

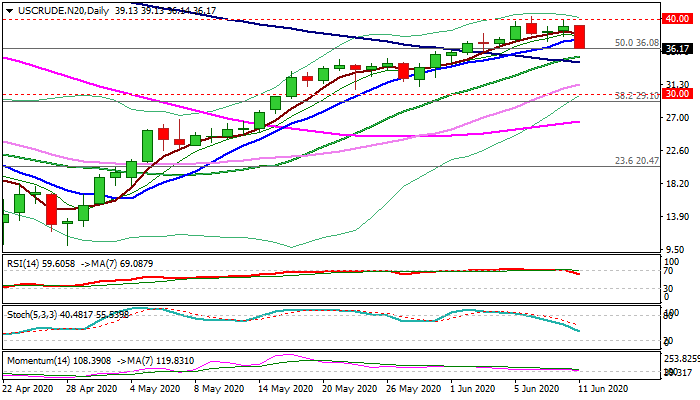

Fresh weakness threatens to break below three-day congestion under psychological $40 barrier, after initial attack failed.

Larger bulls are running out of steam, as pullback was signaled by overbought daily studies and bearish divergence on daily stochastic.

Falling momentum is approaching the borderline of negative territory and adding to negative signals, along with today’s break below pivotal support at $37.29 (10DMA), which needs daily close below for confirmation.

Oil price came under pressure after surprise build in US crude inventories which signal that problem with excess supply persists, while Fed’s gloomy economic outlook adds to negative signals.

Next significant supports at 35.05/$34.33 (diverging 20/100DMA’s are coming in focus, with break here to signal deeper correction.

Res: 37.25; 38.38; 39.13; 40.00

Sup: 36.08; 35.33; 35.05; 34.33