Oil keeps weak tone despite concerns about looming sanctions on Russia

The WTI oil remained at the back foot on Thursday and fell to three-week low, in extension to Wednesday’s 3% drop, as dollar regained traction, partially offsetting supply concerns on looming sanctions on Russian oil products.

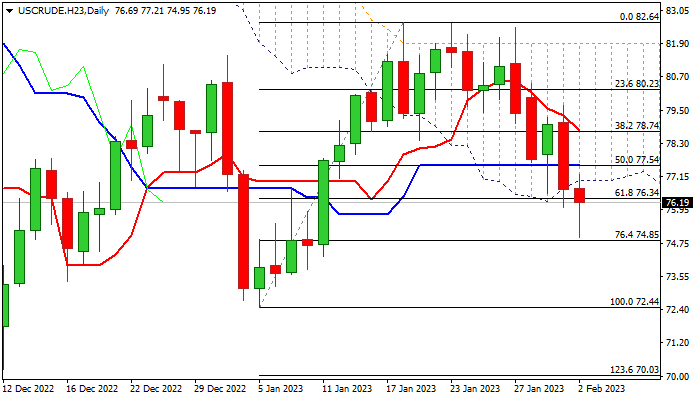

Fresh weakness dipped near Fibo 76.4% of $72.44/$85.64 upleg, with strong negative signal developing on likely daily close below the base of daily Ichimoku cloud ($76.99) and thick cloud is expected to additionally weigh on near-term price action.

Daily chart shows MA’s in full bearish setup and sharp rise of negative momentum that would keep the downside vulnerable.

Bears need to stay below cracked Fibo 61.8% level ($76.34) to maintain pressure for eventual break of Fibo 76.4% support that would open way for full retracement of $72.44/$82.64 bull-leg.

Caution on oversold stochastic which could keep bears on hold, with action to ideally stay below cloud base and extended upticks to be capped by daily Kijun-sen ($77.54) to keep bearish bias.

Res: 76.34; 76.99; 77.54; 77.91

Sup: 74.85; 73.64; 72.44; 70.23