Oil price continues to advance on optimism of extended production cut

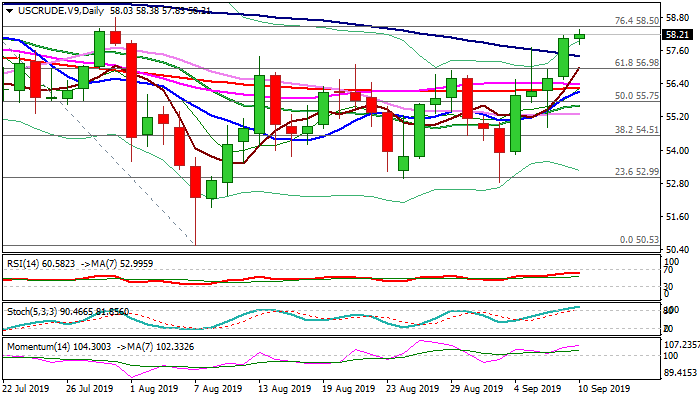

WTI oil extends advance and holds in green for the fifth straight day, with bulls establishing above $58 mark and posting new six-week high at $58.38 on Tuesday.

Fresh optimism on OPEC+ group attempts to extend production cut keeps the price well supported, as Monday’s 2.4% rally resulted in close above pivotal barriers at $56.98 (Fibo 61.8% of $60.96/$50.53) and $57.41 (100DMA) that generated strong bullish signals.

Bullish setup of daily studies supports scenario, but overbought stochastic warns that bulls may take a breather before break above targets at $58.50 (Fibo 76.4%) and $58.81 (31 July high), violation of which would open target at $59.62 (weekly cloud top) and $60 (psychological).

Broken 100DMA now acts as solid support and should ideally keep the downside protected.

Markets focus releases of US crude inventories (API is due later today and EIA report on Wednesday) for fresh signals.

Res: 58.50; 58.81; 59.62; 60.00

Sup: 57.83; 57.41; 57.00; 56.40