Oil price is holds above $100, supported by fundamentals, but techs warn the downside is still at risk

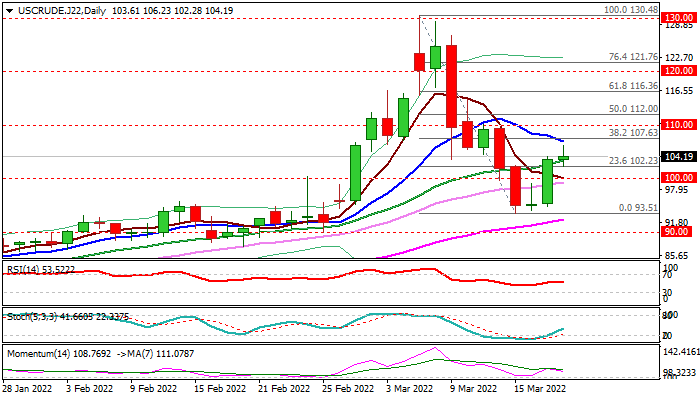

WTI oil returned above $100, after dipping to $93.51 earlier this week and is likely to close above this level that would generate initial positive signal, in addition formation of reversal pattern on daily chart. Although recovery picked up, it still needs more work at the upside to generate firmer reversal signal, with lift and close above pivot at 107.63 (Fibo 38.2% of $130.48/$93.51) needed to confirm.

Daily studies are mixed, with rising negative momentum that keeps the downside vulnerable.

The contract is also on track for the second weekly close in red, although, long tail of weekly candle suggests that bears from new peak at $130.48 are running out of steam, but weekly studies show momentum and stochastic indicators heading south, with enough space at the downside signaling that correction might not be over.

Fundamentals remain the main driver, with rising tensions over Ukraine that directly fuel fears of possible supply disruption, while OPEC output is still short around 1 million bpd that would add to potential nightmare scenario in case Russian supplies stop.

Res: 106.23; 107.63; 110.00; 112.00

Sup: 102.23; 100.00; 99.30; 94.83