USDJPY rises above 120 on hawkish Powell and uncertainty over Ukraine war

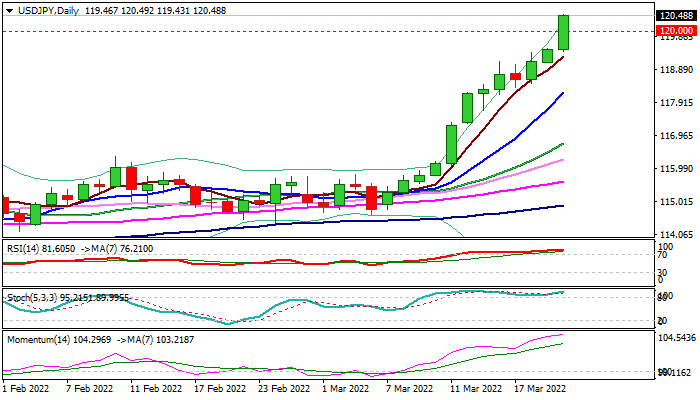

The USDJPY resumed its steep ascend on Tuesday, advancing nearly 1% in Asian/early European trading.

Fresh bullish acceleration broke through pivotal barriers at 119.50 (Fibo 76.4% of 125.84/98.99) and psychological 120 level, generating strong bullish signal.

The dollar received fresh boost from comments of Fed’s chief Powell, who pointed to the central bank’s readiness to become more aggressive to restore the price stability, while news of no progress in Russia-Ukraine peace talks and growing uncertainty sparked fresh safe-haven demand.

Signs of further divergence between the monetary policies of Fed and a Bank of Japan, as Japanese central bank shows no signs of tightening in the near future, further deflate yen.

Break above 120 opens way for further advance, with Jan 2016 high (121.67) being in focus and guarding 123.74 (Nov 2015 high).

Strongly overbought daily studies suggest some corrective action in the coming sessions, with shallow dips (to be ideally contained at 119.50 zone) expected to offer better opportunities to re-join firmly bullish market.

Res: 121.00; 121.67; 122.00; 123.00

Sup: 120.00; 119.50; 119.28; 119.00