Oil price slumps below $100 on demand concerns

WTI oil price fell nearly 5% on Monday, extending weakness well below psychological $100 level and hitting the lowest in two weeks.

Oil came under increased pressure on concerns that extended lockdowns in Shanghai and hawkish signals from the US central bank about stronger than expected rate hike would slow global growth and hurt oil demand, offsetting support from tight global supply, plans in the EU about imposing ‘smart sanctions’ against Russian oil imports and reduced supply from Libya.

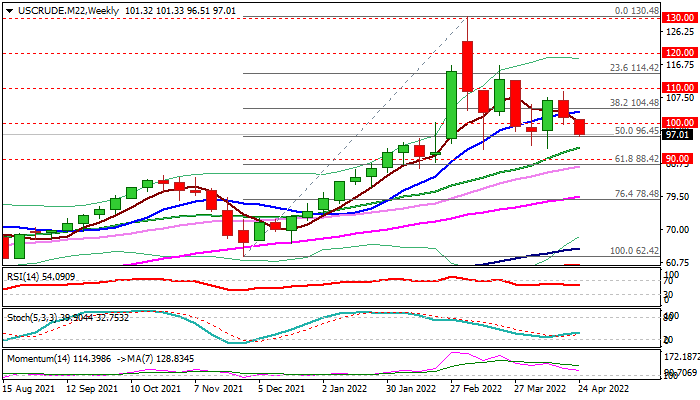

Fresh drop weakens daily studies, with initial negative signal expected on close below $100 and next on sustained break below dented Fibo support at $96.45 (50% of $62.42/$130.48 upleg) that would expose key higher base at $96.90/$96.60 zone, loss of which would confirm reversal and signal deeper drop of oil price.

Broken $100 support reverted to solid resistance, which should keep the upside protected and maintain bearish bias.

Only rebound and close above broken Fibo support at $104.48 (38.2% of $62.42/$130.48) would ease downside pressure.

Res: 100.00; 101.33; 103.42; 14.48

Sup: 96.45; 93.22; 92.92; 92.60