Oil price surges on weaker dollar and persisting supply risks

WTI oil price rose strongly on Friday, advancing 3.3% in the mid-European session, lifted by stronger dollar and persisting supply risks, though China’s Covid restrictions and recession fears continue to weigh and may limit gains.

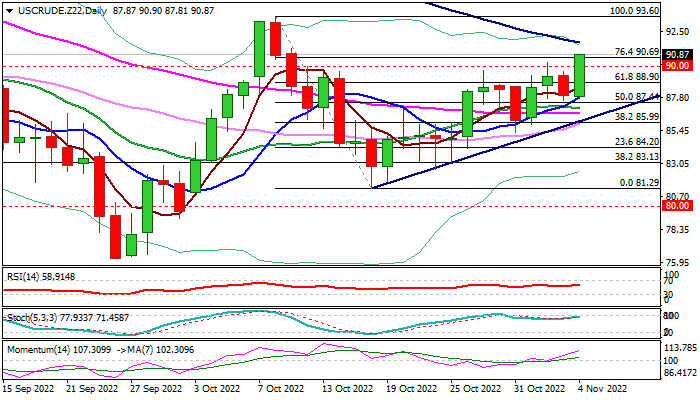

Friday’s strong bullish acceleration broke through some important barriers, the top of thick daily cloud ($89.06) and psychological $90 level, as well as pivotal Fibo resistances at $88.90 and $90.69 (Fibo 61.8% and 76.4% of $93.60/$81.29 respectively), with close above these levels to confirm strong bullish signal and open way for further gains, exposing targets at $91.77 (falling 100DMA) and key near-term barrier at $93.60 (Oct 10 lower top).

Daily studies are in full bullish setup and support the action, which sees a weekly close above broken $90 barrier as a minimum requirement to keep fresh bulls in play.

Res: 91.77; 92.87; 93.60; 94.36

Sup: 90.00; 89.60; 88.90; 87.77