Oil prices extend recovery on fading Omicron fears, Iran

WTI oil rallies for the second straight day and accelerates well above psychological $70 level, in extension of Monday’s 4% advance.

Receding fears about the Omicron variant on rising hopes that virus will not set the global economy back, revived the risk appetite.

Stall of Iran nuclear talks signals delay of the return of Iranian oil that also inflated oil prices.

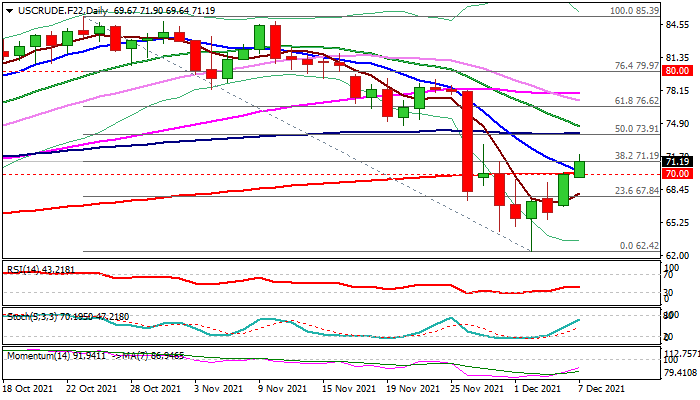

WTI price rose to the highest in 1 ½ week in European trading on Tuesday, on probe through pivotal Fibo barrier at $71.19 (38.2% of $85.39/$62.42 pullback), generating further reversal signal after last Thursday’s Hammer.

Close above $70 (reinforced by 200DMA) is a minimum requirement for maintaining reversal signal, which would be boosted by daily close above $71.19 Fibo barrier, for test of key resistances at $73.59/67 (base of thick daily cloud / daily Kijun-sen).

Improving daily studies add to fresh bullish sentiment, with focus on today’s release of API crude stocks report and crude inventories on Wednesday, which could provide fresh signals.

Res: 71.90; 72.90; 73.67; 74.75

Sup: 70.93; 70.00; 69.64; 67.84