Oil prices fall 4.5% on growing expectations for large US rate hike / demand concerns

WTI oil price slumped on Thursday, being down over 4.5% for the day, driven by further rise of the dollar on prospects of larger than expected US rate hike, on central bank’s policy meeting due later this month.

Also, growing fears of recession that may hurt demand for oil and lower US gasoline prices, which pulled back from their record highs, added pressure on oil prices.

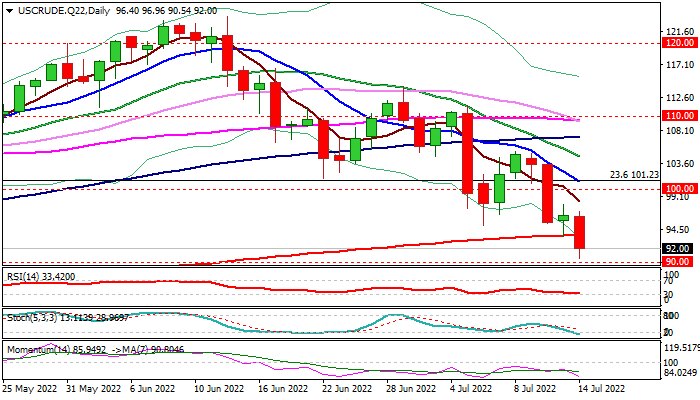

Fresh weakness broke through key supports at $93.83 (200DMA) and $92.92 / $92.64 ( lows of Apr 11 / Mar 16 which created a higher base on daily chart).

Sustained break of these levels is required to generate strong bearish signal on completion of failure swing pattern on daily and weekly chart that would signal a deeper correction of post-pandemic $6.52/$130.48 rally.

Bearish studies on daily chart add to negative sentiment, with weekly close below $100 level (very likely scenario) as initial signal and additional signal on clear break of $92.92/$92.64 base.

Extension below $90 would further weaken the structure and risk test of 55WMA ($88.07) and next pivot at $83.13 (Fibo 38.2% of $6.52/$130.48 advance.

Res: 93.03; 96.96; 97.94; 98.45

Sup: 90.54; 90.00; 88.07; 87.44