Oil prices remain under increased pressure on global oil demand concerns

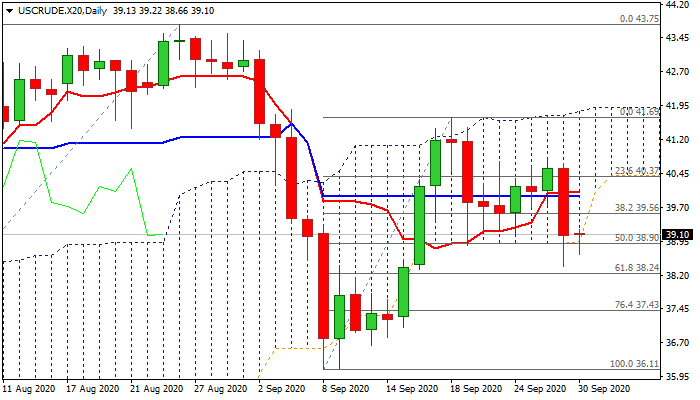

WTI oil stands at the back foot on Wednesday and capped by the base of thick daily cloud ($40.0/$41.92) keeping negative tone after Tuesday’s 3.7% drop.

Global death toll on coronavirus surpassed one million and rising number of new cases that prompted authorities to impose stronger restrictions, boosted concerns about further drop in global demand.

Return of Libyan exports added to negative signals and increased pressure on oil prices.

Tuesday’s fall completed failure swing pattern on daily chart, warning of extension of bear-leg from lower top at $40.77, posted on 28 Sep.

Fresh bears need repeated close below broken falling 200DMA ($39.46) to confirm negative stance and close below daily cloud base, to signal further easing.

Extension below pivotal Fibo support at $38.2% (61.8% of $36.11/$41.69) would boost bearish signal.

Traders focus today’s release of US weekly crude stocks (1.56 mln bls build f/cvs 1.63 mln bls draw previous week) with rise in crude inventories to further depress oil prices.

Res: 39.26; 39.46; 40.05; 40.77

Sup: 38.66; 38.38; 38.24; 37.43