Oil remains under strong pressure on prospect of US rate hike acceleration; US labor data eyed for fresh signals

The WTI crude oil price remains firmly in red for the fourth straight day and on track for a strong weekly drop.

Oil price lost traction after probe above psychological $80 barrier failed to hold gains and accelerated sharply lower on hawkish comments from Fed Chair Powell.

The fact that inflation in the US remains stubbornly high, opens prospect of further and stronger than expected rate hikes and strongly deflated oil demand.

Further and probably faster rise in the US borrowing cost, which will push interest rates above initial estimations, darkened the global oil demand outlook and strongly soured traders’ sentiment, resulting in sharp fall of oil price in past few days.

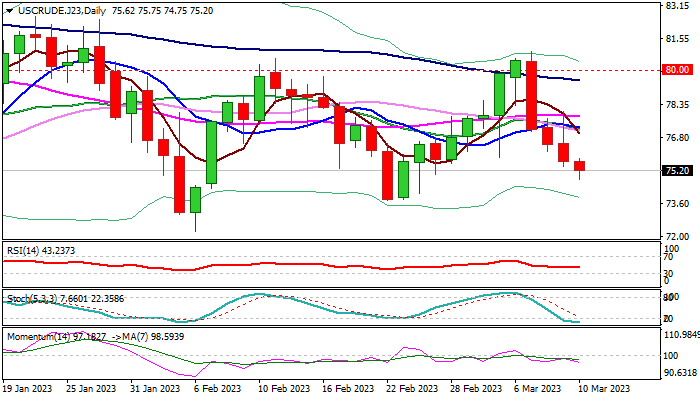

This week’s drop, which is likely to mark the strongest weekly fall since late Jan / early Feb, already significantly weakened the structure on daily chart, as fresh acceleration lower has so far retraced over Fibo 76.4% of $73.77/$80.90 bull-leg and eye key near-term supports at $73.77 (Feb 22/23 higher base.

Technical studies show rising negative momentum, south-heading RSI and moving averages in full bearish configuration, which add to negative fundamentals and maintain pressure on oil price, although oversold stochastic may temporary slow the fall.

Markets are awaiting US jobs data for February, to get more evidence about the strength of the US labor market, one of key indications for the US central bank in decision about the monetary policy in coming months.

Stronger than expected NFP numbers would confirm that the US labor market remains tight despite high interest rates and open way for further rate hikes, which would add pressure on crude oil price.

Res: 75.75; 76.70; 77.29; 78.02

Sup: 74.75; 73.77; 72.24; 70.00