Technical studies warn of fresh weakness but US jobs data seen as a key driver

The Euro remains at the front foot in European session on Friday and extends recovery into second straight day, retracing almost 50% of post Powell’s sharp fall.

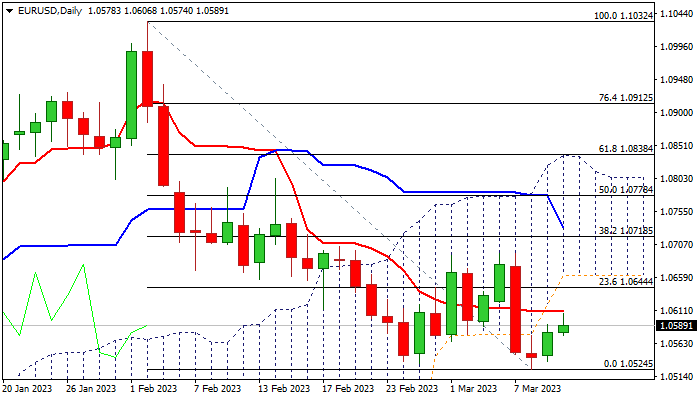

Bounce from Wednesday’s two-month low (1.0524) is struggling at the first obstacle at 1.0609 (daily Tenkan-sen), as daily studies are still weak (momentum remain negative, price action stays below thick daily cloud) warning that fresh bulls may run out of steam and keeping the downside vulnerable.

Fundamentals are again going to be the key driver and markets await release of US February jobs data for fresh direction signals.

The latest hawkish comments from Fed Chair Powell, who said that policy tightening cycle is likely to extend and push interest rates beyond initial estimations, with possible acceleration of the pace of rate hikes, in efforts to bring stubbornly high inflation under control, put the euro under increased pressure as traders increased dollar longs on expectations of further rise of the borrowing cost.

US non-farm payrolls data are in focus as the second key event this week, as markets look for more evidence about the situation in the US labor market, one of crucial factors which will influence Fed’s decisions in the near future.

Markets were a bit concerned after US weekly jobless claims rose last week, seeing possibility that this may not be just isolated case, but initial signal that the US labor sector started to weaken.

If NFP (Feb f/c 205K vs Jan 517K) come above expectations, this will be positive signal for the dollar and bring the single currency under fresh pressure, risking test of key support at 1.0460 (Fibo 38.2% of 0.9535/1.1032 / 55WMA).

Conversely, disappointing NFP numbers would spark fresh bullish acceleration and lift the EURUSD pair through pivotal barriers at 1.0661/94 (daily Ichimoku cloud base / early Mar lower platform).

Res: 1.0609; 1.0644; 1.0661; 1.0694

Sup: 1.0574; 1.0546; 1.0524; 1.0483