Optimistic fundamentals prevent deeper pullback for now

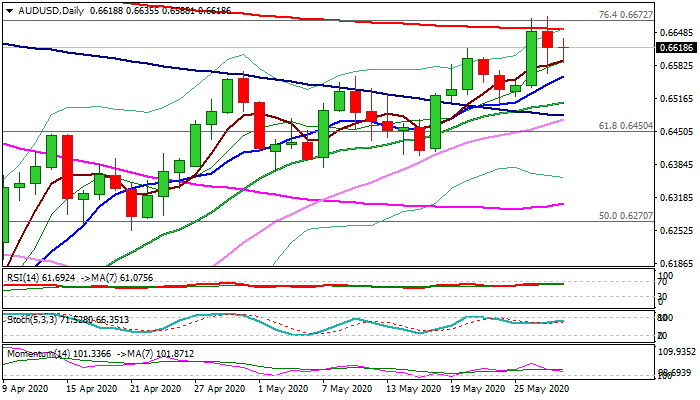

The Aussie remains bid ion Thursday despite double failure at 200DMA (0.6657), underpinned by fresh optimism that economic downturn over pandemic lockdown may be less severe than feared.

This so far fades negative signals on repeated upside rejection that may cause stronger pullback on profit-taking and formation of bull-trap above 200DMA.

Daily techs are bullish and supportive for renewed attack at 200DMA, clear break of which would signal continuation of larger uptrend from 0.5509 (19 Mar low).

Near-term action is expected to remain biased higher on repeated close above former high at 0.6616 (reinforced by rising 5DMA), with extended dips towards rising 10DMA (0.6560) not to seriously harm bulls.

But close below 10DMA would generate initial signal of top and risk deeper pullback towards 0.6507 (20DMA) and 0.6574 (100DMA).

Res: 0.6635; 0.6657; 0.6672; 0.6684

Sup: 0.6588; 0.6560; 0.6537; 0.6507