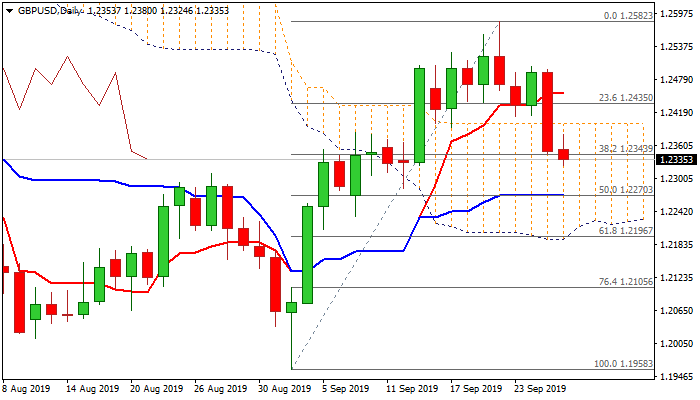

Penetration of daily cloud boosted bears

Bears break through pivotal Fibo support at 1.2343 (38.2% of on Thursday 1.1958/1.2582 / 20DMA) on Thursday, extending Wednesday’s 1.1% fall (the biggest one-day drop since 29 July) which generated strong bearish signal on break of key support at 1.2399 (daily cloud top).

Sterling came under increased pressure on the latest twists in Brexit saga, as Supreme Court ruled parliament suspension as illegal, Boris Johnson urges election, parliament may opt for vote for another Brexit referendum and also tighten law that bans no deal scenario.

Weaker techs add to negative near-term outlook, as bears look for extension through 1.2300 round-figure support and test of next significant level at 1.2270 (50% retracement of 1.1958/1.2582 / daily Kijun-sen).

Bears may pause and re-position for fresh push lower as oversold daily stochastic and momentum bouncing from the centerline warn.

Broken daily cloud top now marks solid barrier which is expected to limit upticks and keep bears in play.

Res: 1.2343; 1.2380; 1.2399; 1.2415

Sup: 1.2324; 1.2300; 1.2270; 1.2233