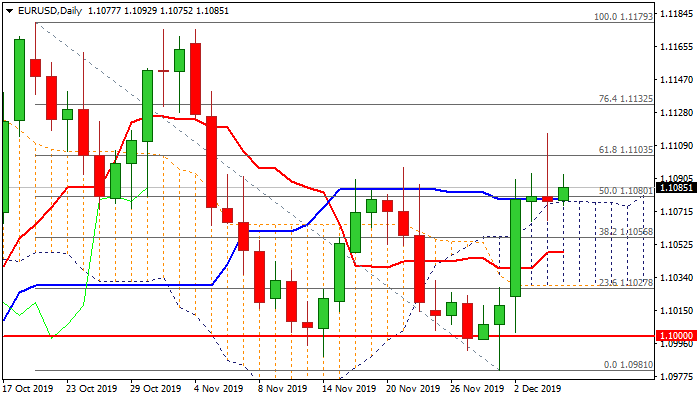

Positive tone above daily cloud but risk of bull-trap exists

The Euro found fresh bid on Thursday and bounced from daily cloud top (1.1078) which underpins for the third straight day and keeps bullish bias intact.

Two consecutive Dojis (Tue/Wed) with Wednesday’s candle having very long upper shadow, signaled strong indecision at pivotal barriers at 1.1096/1.1103 (21 Nov high / Fibo 61.8% of 1.1179/1.0981).

Threats of bull-trap at 1.1103 Fibo barrier and fresh weakness remain alive and supported by fading daily momentum and stochastic reversing from overbought zone.

Negative scenario would require break and close below pivotal supports at 1.1078/67 (top of thick daily cloud / falling 100DMA) for initial signal, with extension below broken Fibo 38.2% barrier (1.1056) to confirm.

Downbeat German factory orders (Oct -0.4% vs 0.3% f/c) and EU retail sales (Oct m/m -0.6% vs -0.3% f/c; y/y 1.4% vs 2.2% f/c) also weigh.

On the other side, fresh upside attempts need break and close above cracked Fibo barrier at 1.1103 to generate bullish signal for extension of recovery rally from 1.0981 (21 Nov spike low).

Res: 1.1092; 1.1103; 1.1115; 1.1132

Sup: 1.1078; 1.1067; 1.1056; 1.1040