Risk of reversal increases

The Aussie dollar dips on Thursday on disappointing Australia’s retail sales (Oct 0.0% vs 0.3% f/c) and trade balance (Oct surplus 4.5B vs 6.1B f/c), increasing risk of reversal.

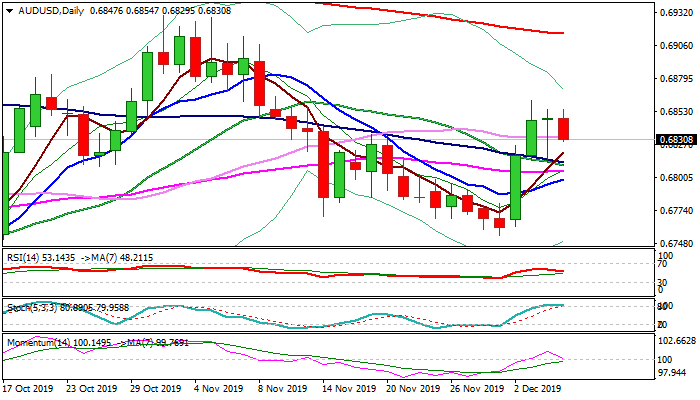

Tuesday’s action stalled at key Fibo barrier at 0.6862 and Wednesday’s trading ended in long-tailed Doji, with fresh weakness today, adding to signals of formation of reversal pattern on daily chart.

Weakening momentum and stochastic reversing from overbought zone, add to negative signals.

Extension and close below pivots at 0.6822 (daily cloud top) and 0.6820 (Fibo 38.2% of 0.6754/0.6862) would generate bearish signal for deeper pullback.

Only firm break above 0.6862 (Fibo 61.8% of 0.6929/0.6754) would neutralize downside risk and signal continuation of recovery from 0.6754 (29 Nov low).

Res: 0.6854; 0.6862; 0.6888; 0.6906

Sup: 0.6820; 0.6808; 0.6800; 0.6780