Pound may accelerate lower if BoE softens tone about next steps

Cable is standing at the back foot in European trading on Thursday, ahead of key event – BoE rate decision.

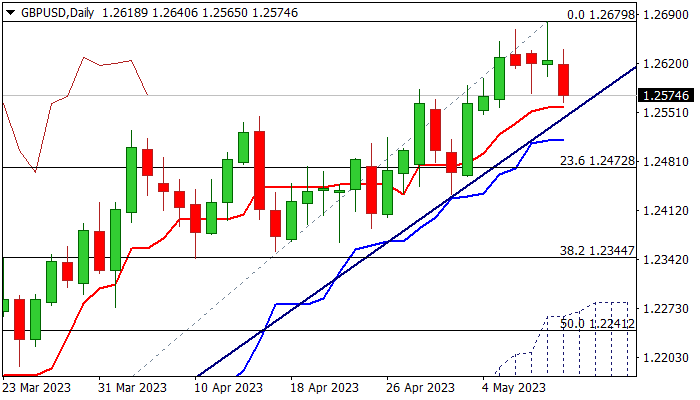

Extension of pullback from new 2023 high (1.2679, posted on Wednesday) hit weekly low and pressure pivotal supports at 1.2555 zone (bull-trendline off 1.1802, Mar 8 low / daily Tenkan-sen / Fibo 38.2% of 1.1802/1.2679 rally).

Sterling was deflated after the action in past three days showed indecision, with south-heading daily indicators warning of possible deeper pullback instead of limited correction which would mark positioning for fresh push higher.

Although the Bank of England is about to raise interest rate by 25 basis points to 4.5%, in a twelfth consecutive hike, traders will focus on signals of BoE’s next steps as inflation in the UK remains very high (10.1%; core 6.9%) and markets price for another 75 basis points hikes including today’s increase.

The central bank needs to balance between stubbornly high inflation and signs of negative impact of high borrowing cost to the economy.

Any change in BoE’s rhetoric and softer tones would disappoint traders and prompt fresh selling of pound, which may lead into deeper correction and mark temporary top at 1.2679.

Initial strong negative signal to be expected on break of 1.2555, with confirmation of signal on extension and close below daily Kijun-sen (1.2511) which would risk acceleration towards key supports at 1.2350 zone (mid-Apr higher base / Fibo 38.2% of 1.1802/1.2679 uptrend).

On the other hand, bullish scenario sees fresh acceleration higher after limited pullback and possible attack at pivotal Fibo barrier at 1.2759 (61.8% of 1.4249/1.0348).

Res: 1.2602; 1.2640; 1.2679; 1.2759

Sup: 1.2555; 1.2511; 1.2472; 1.2435