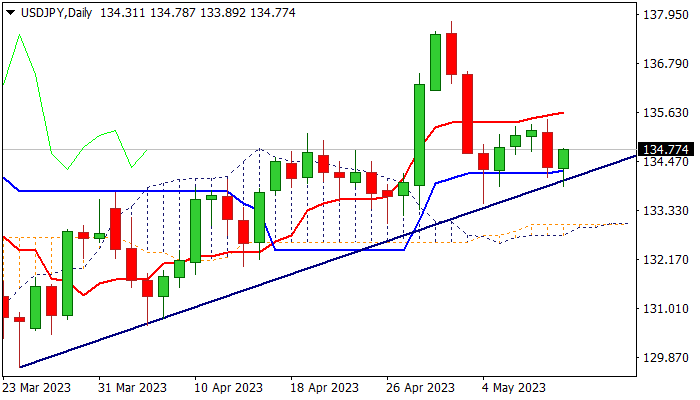

Slight bullish bias above trendline support but near-term outlook still mixed

The USDJPY edges higher in early Thursday, keeping slight bullish bias as recent drops (larger pullback from May 2 peak at 137.77 and Wednesday’s dip) were contained by rising bull-trendline off 129.61 (Mar 24 low) and also registered several daily closes above daily Kijun-sen (134.27).

However, daily studies are still lacking clear direction signal as moving averages are in mixed setup and near-term action continues to range between daily Tenkan-sen (135.64) and daily Kijun-sen.

Bulls need a clear break above cracked Fibo barrier at 135.13 (38.2% of 137.77/133.50 bear-leg) to firm near-term structure, with lift above daily Tenkan-sen to spark stronger acceleration higher.

Conversely, loss of pivotal supports at 134.27/13 (daily Kijun-sen / trendline support) would weaken the tone and risk break of 133.50 pivot (May 4 trough), loss of which would signal a continuation of a bear-leg off 137.77 top

Res: 136.98; 137.90; 138.17; 139.58

Sup: 136.14; 135.90; 135.10; 133.95