Record inflation dents recovery

The Euro loses traction on Friday following report about record Eurozone inflation in September that is expected to trigger more aggressive action from the ECB, with higher interest rates to negatively impact economic growth and increase pressure on the single currency.

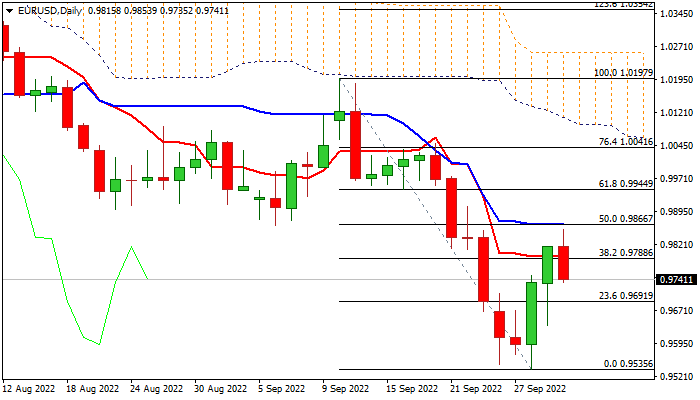

The pair made significant recovery in past two days (up 2.3%) and generated bullish signal on close above 0.9788/92 pivots (Fibo 38.2% of 1.0197/0.9535 / daily Tenkan-sen) but repeated close above these levels .is required to confirm signal.

Fresh weakness warns that recovery rally may have peaked, with the notion being supported by fresh rise of negative momentum and south-turning RSI, though the action would need more evidence on dip and close below pivotal double-Fibo supports at 0.9690 zone (broken Fibo 23.6% of 1.0197/0.9535 / 50% retracement of 0.9535/0.9853 recovery leg) that would turn near-term bias into negative mode and signal a lower top.

Former barriers at 0.9788/92 became again resistances and guard key point at 0.9866 (50% of 1.0197/0.9535 / daily Kijun-sen).

Res: 0.9792; 0.9853; 0.9866; 0.9907

Sup: 0.9735; 0.9692; 0.9657; 0.9635