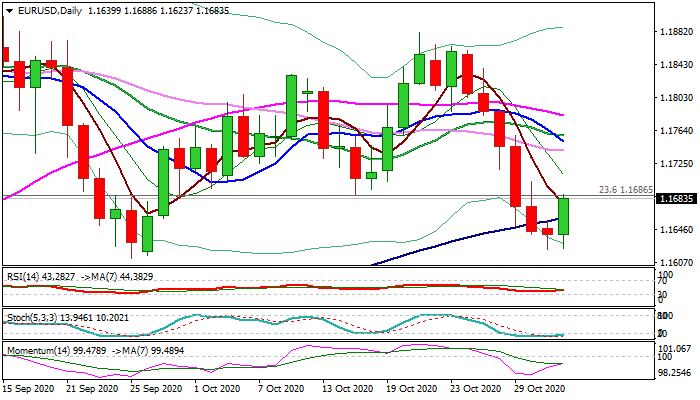

Recovery accelerates but bears to remain alive while key barriers at 1.1706/21 cap

The Euro jumps in early Tuesday after bears faced strong headwinds from key 1.1600 support zone (25 Sep low / 50% retracement of 1.1168/1.2011) and Monday’s action ended in daily Doji candle.

Fresh rally accelerates on profit-taking from last week’s steep fall and attempts to form reversal pattern on daily chart.

Signals are still mixed as the single currency remains under pressure from ECB’s signals of further easing, risk-off mode on fears of further economic recovery slowdown on fresh restrictive measures and uncertainty about the results of US elections.

Rising momentum on daily chart and stochastic attempting to reverse from oversold territory, support current recovery, also attracted by daily cloud twist later this week.

On the other side, overall negative sentiment and south-heading weekly indicators, suggest limited corrective action which is expected to provide better opportunities to re-enter bearish market for eventual break of 1.16 pivot and extension of pullback from 1.2011 peak.

Strong barriers at 1.1706/21 (daily cloud base / Fibo 38.2% of 1.1880/1.1622) should limit upticks and keep bears intact, while firm break here would sideline bears and signal stronger correction of 1.2011/1.1622 fall.

Res: 1.1706; 1.1721; 1.1740; 1.1758

Sup: 1.1655; 1.1622; 1.1612; 1.1590