Recovery gains pace on fresh supply concerns

The WTI oil price rises for the second straight day as fresh supply concerns following the closure the US Keystone Pipeline which ships oil from Canada to the US, offset fears of weaker demand.

The supply shortage in the world’s biggest oil consumer suggest that US crude inventories would drop, adding to positive signals from China’s easing of Covid restrictions, which contributes to overall improving near-term sentiment.

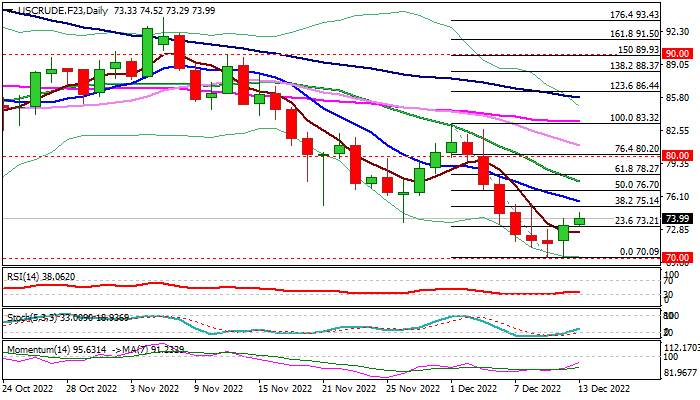

Fresh bounce left a double bottom just above psychological $70 support and managed to close above initial Fibo barrier at $73.21 (23.6% of $83.32/$70.09 bear-leg), generating initial bullish signal, which still requires verification on extension through pivots at $75.14/$75.68 (Fibo 38.2% / falling 10DMA).

On the other hand, daily studies remain overall negative, as MA’s are in bearish setup and north-heading 14-d momentum is still below the centreline which divides positive and negative territory.

Large last week’s bearish candle also weighs on recovery, which needs stronger momentum to pick up.

Res: 74.52; 75.14; 75.68; 76.70

Sup: 73.21; 72.57; 71.11; 70.00