Recovery picks up on optimistic trade-negotiations news but cautious on expectations for crude inventories build

WTI oil price eventually reacted on optimistic tones from US/China trade talks and jumped above $54 mark after holding within narrow range in Asia / Europe on Tuesday.

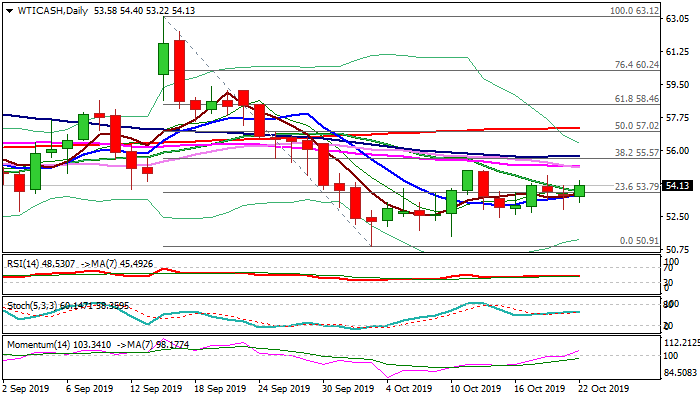

Fresh advance on improved near-term sentiment, generated bullish signal on break above converging 10/20DMA’s ($53.66/84) as daily cloud twist ($55.73) attracts and action being supported by rising bullish momentum on daily chart.

Fresh advance needs lift above $54.93 (11 Oct high) to generate stronger signal for continuation of recovery leg off $50.91 (3 Oct low).

Traders remain cautious ahead of release of US crude stocks data as American Petroleum Institute’s report is due later today and Energy Information Administration will release their report on Wednesday, with expectations for both reports to show build in crude inventories that would slow recovery.

Close above 10DMA is needed to maintain bullish bias, while break below and violation of pivotal support at $52.44/45 (15 Oct trough / Fibo 61.8% of $50.91/$54.93 recovery leg) would sideline bulls and shift near-term focus lower.

Res: 54.40; 54.67; 54.93; 55.17

Sup: 53.83; 53.66; 53.22; 52.84