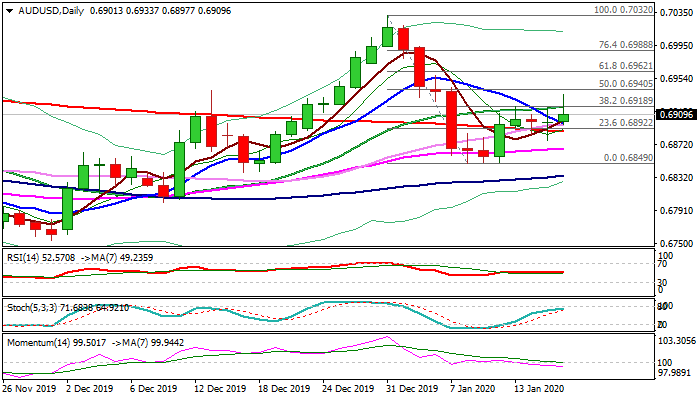

Relief advance on trade deal needs close above 0.6919 pivot to signal bullish continuation

The Australian dollar advanced on Thursday and hit the highest since 7 Jan, in attempts to eventually break above three-day congestion, which was signaled by double Doji candles.

Strong risk sentiment after US-China trade deal was signed, boosted Aussie for probe through pivotal barrier at 0.6919 (Fibo 38.2% of 0.7032/0.6849 / 20DMA / top of recent congestion).

Close above here is required to generate signal for extension of bull-leg from 0.6849 higher base.

Caution on possible recovery stall and repeated close below 0.6919 as negative daily momentum is rising and RSI is neutral.

Extended sideways mode could be expected while the price remains above 200DMA (0.6889), while firm break below 200DMA would generate negative signal.

Res: 0.6919; 0.6940; 0.6962; 0.6988

Sup: 0.6897; 0.6889; 0.6877; 0.6849