Remains directionless after little reaction on RBA; Australian data

The Australian dollar showed mild reaction on mixed Australian data and RBA rate decision on Tuesday.

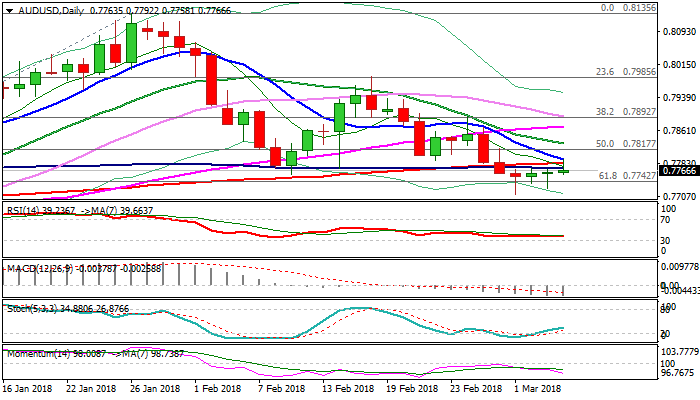

The pair ticked above pivotal barriers at 0.7772/85 (100/200SMA’s) and hit session high at 0.7792, where rally was capped by falling 10SMA.

However, upticks were short-lived as the price returned to the levels where it traded before data at 0.7760 zone.

Australian current account surged in Q4, showing surplus of A$14 billion, up from A$11 billion surplus in Q3 and well above forecasted deficit of A$12.3 billion.

Positive impact from upbeat current account numbers was offset by weaker than expected retail sales which rose by 0.1% in Jan, undershooting forecast for 0.4% rise, but showing better result from Dec, when retail sales were down by 0.5%.

Reserve bank of Australia left interest rates unchanged as expected on today’s meeting. Australian interest rates remain at record low at 1.5% and the central bank signaled that will likely remain on hold in coming months as it is unlikely that the economy would grow 3% or more in 2018.

Techs on daily chart remain weak, with MA’s still in firm bearish setup and fresh bearish momentum building that keeps negative near-term outlook.

The pair remains in a choppy mode in past few sessions, with repeated downside rejections, keeping bears limited for now. Repeated failures to close below cracked pivot at 0.7742 (Fibo 61.8% of 0.7500/0.8135 rally) lacking firmer bearish signal which would be generated on sustained break below.

The upside actions remain limited and 100/200SMA’s still acting as active barriers, following today’s brief probe above and guard another strong barrier at 0.7817 (base of thick daily cloud).

The pair looks for a catalyst to spark fresh action to break out of current congestion and generate fresh direction signal.

Performance of the US dollar which firmed after initial fears about possible trade war started to fade, would give more clues about the near-term direction of the Aussie..

US jobs data on Friday are closely watched for fresh signals.

Res: 0.7772; 0.7785; 0.7792; 0.7817

Sup: 0.7758; 0.7742; 0.7712; 0.7700