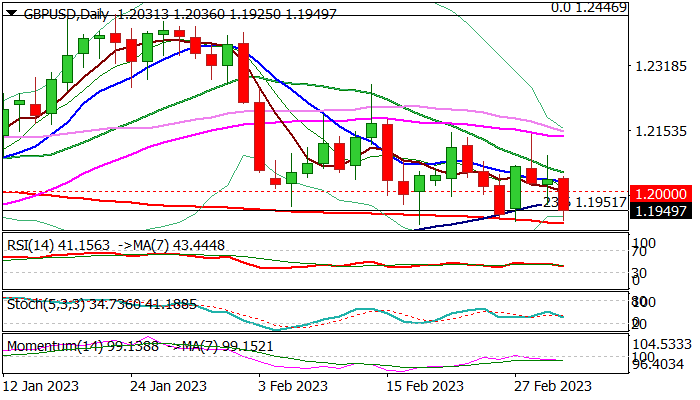

Renewed bears probe again through key support zone

Cable lost ground after recovery was strongly rejected at the base of falling weekly Ichimoku cloud on Tuesday and fresh bearish acceleration on Thursday broke psychological 1.20 level, to test key support zone at 1.1950/14 (Fibo 38.2% of 1.1146/1.2446 / 200DMA / Feb 17 spike low), which contained several attacks in past three weeks.

Weakening structure of daily studies (negative momentum is rising / RSI is heading south / moving averages almost in full bearish setup) is maintaining downside pressure, while descending weekly cloud continues to weigh on near-term action after larger recovery was capped by the cloud base on Jan 23.

Also, a double-top pattern has been formed (1.2447, tops of Dec 14 and Jan 23) and adds to bearish pressure, although the pattern still requires a confirmation on firm break of pivotal support at 1.1841 (2023 low, posted on Jan 6).

In addition, long upper shadows of weekly candlesticks of past three weeks, indicate persisting bearish pressure.

Fresh bears look for eventual break of 1.1950/14 support zone to spark acceleration lower, with violation of 1.1841 pivot to unmask next key support at 1.1645 (Fibo 38.2% retracement of entire recovery from 1.0348 (2022 low, posted on Sep 26) to 1.2447 peak.

Broken 1.20 support reverted to initial resistance, followed by key barriers at 1.2147/43 (Feb 21/28 tops, reinforced by 55DMA).

Res: 1.2000; 1.2046; 1.2089; 1.2147

Sup: 1.1918; 1.1900; 1.1841; 1.1769