Rising oil and stock prices underpin Aussie’s recovery

The Australian dollar extends recovery into second day, signaling formation of higher low at 0.6372, supported by unchanged RBA and risk sentiment on rising stocks and oil prices.

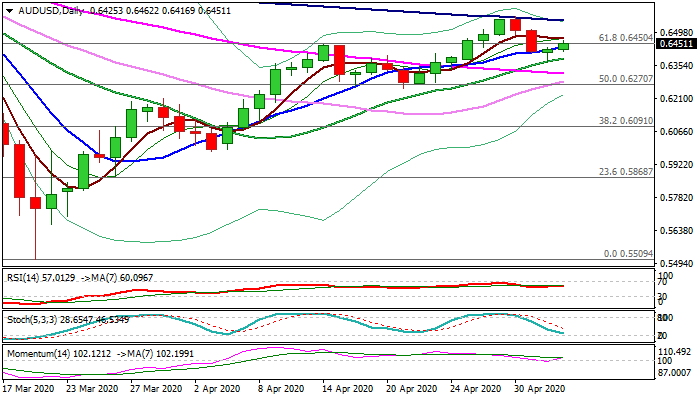

Fresh gains through 0.6438/48 (10DMA / Fibo 38.2% of 0.6569/0.6372 pullback) eye barrier at 0.6471 (50% retracement) with minimum requirement to generate bullish signal on close above 0.6448.

Larger uptrend from 0.5509 (2020 low, posted on 19 Mar) remains fully in play, with shallow pullback seen as positioning for fresh advance.

Bulls faced strong headwinds from falling 100DMA (currently at 0.6550) which repeatedly capped the rally last week.

Extension above 0.6500 zone is needed to confirm reversal and open way for fresh attack at 100DMA, which guards another significant barrier at 0.6677 (200DMA).

Repeated close above rising 10DMA (0.6439) would add to positive signals.

Ascending 20DMA, which contained three-day pullback, marks pivotal support (0.6387) and only break here would soften near-term tone and risk deeper correction.

Res: 0.6471; 0.6500; 0.6523; 0.6550

Sup: 0.6438; 0.6416; 0.6387; 0.6319