Safe-haven yen benefits from fresh uncertainty on Trump news

The pair fell 0.5% on Friday morning after news that President Trump and his wife tested positive on Covid-19.

Traders moved into safe-haven yen on rising uncertainty that sparked risk aversion in the market.

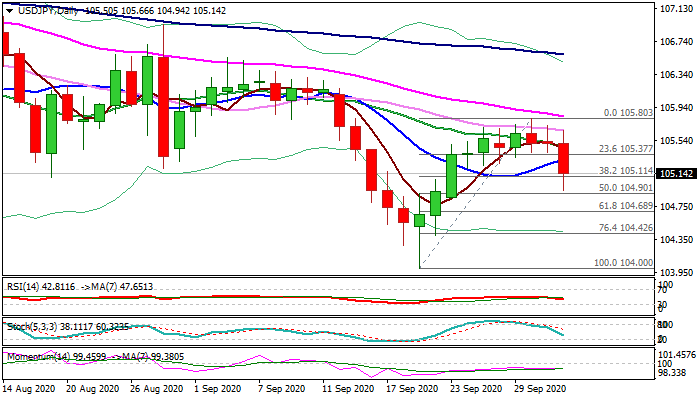

Fresh weakness probed below important supports at 105.11/00 (Fibo 38.2% of 104.00/105.80 / round-figure, with today’s close below these levels to open way for further weakness.

Firm break of 105.00 zone would expose next pivotal support at 104.68 (Fibo 61.8%), loss of which would signal an end of 104.00/105.80 correction and open way towards key supports at 104.18/00 (31 July / 21 Sep lows).

Daily studies maintain negative momentum and MA’s in bearish setup that adds to downside pressure.

The uncertainty is likely to persist and spark stronger volatility, as markets await today’s key event – release of US labor report.

US non-farm payrolls are expected to add 850K jobs in September, compared to 1.37M in August, which points to further slowdown in job growth for the fourth straight month.

Average earnings are expected to rise by 0.2%, compared to 0.4% previous month that would add to concerns about the growth in the US labor sector, hit by the second wave of Covid-19.

Res: 105.31; 105.45; 105.66; 105.80

Sup: 105.11; 104.94; 104.68; 104.42